Life Insurance for Dummies

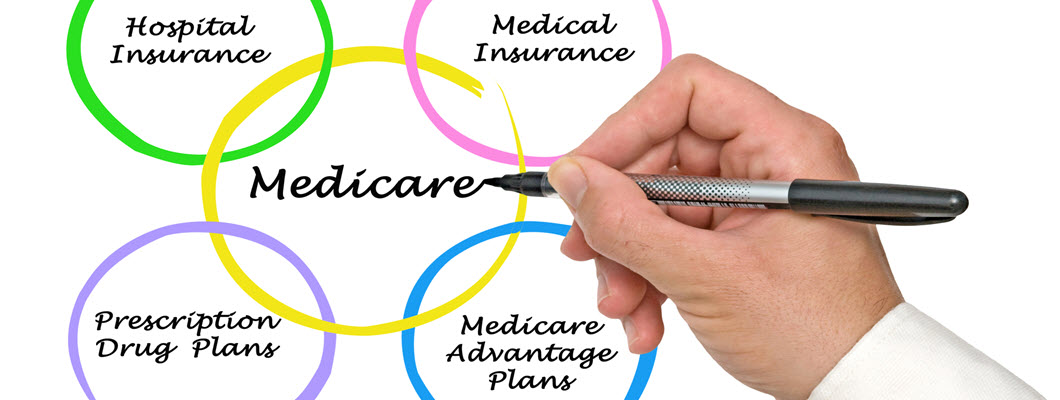

There are various insurance plans, and understanding which is best for you can be challenging. This overview will certainly discuss the various sorts of insurance policy and what they cover. We will certainly also offer pointers on choosing the ideal plan for your requirements. Tabulation The most usual type of insurance coverage is medical insurance.

An annuity is a kind of insurance plan that provides you with a stream of revenue for a specified time period. As an example, annuities can supplement your retirement income or supply economic safety and security for your family members in the event of your death. Accident insurance coverage is a plan that will certainly supply monetary protection during an accident.

Handicap insurance is a kind of policy that will supply you with financial security if you come to be disabled and are unable to work. This plan can cover the price of your treatment, lost earnings, as well as other expenses. Long-lasting treatment insurance is a kind of plan that will certainly give economic protection if you require to obtain long-lasting care.

The 8-Minute Rule for Insurance Company

Interment insurance policy is a kind of policy that will certainly provide monetary security to cover the expense of your funeral service and also various other related expenditures. This policy can cover the cost of your funeral, funeral, and other relevant costs (insurance). Pet dog insurance policy is a sort of plan that will supply economic protection to cover the cost of your animal's treatment.

Travel insurance coverage is a sort of plan that will provide you with economic protection to cover the cost of your traveling expenditures. This plan can be used to cover the price of your traveling, accommodations, and also various other associated expenses. Traveling clinical insurance coverage is insurance when traveling that will provide you with financial protection if you require to get treatment while you are traveling. traveling medical insurance policy can be expensive, so searching and also contrasting prices before acquiring is necessary (Arc Insurance Cincinnati boat insurance). Home mortgage insurance is a policy that will certainly give monetary security if you can not make your home mortgage settlements. This policy can be used to cover the cost of your home mortgage, interest, as well as other associated costs.

You will likely need to acquire occupants insurance coverage if you lease your residence. Renters' insurance coverage can be pricey, so it is essential to go shopping about and contrast prices before buying a plan.

Some Known Details About Life Insurance

This policy can cover the price of your dental treatment, shed earnings, and other expenses.

Lots of other kinds of policies are available, so it is important to study as well as discover one that best fits your needs. If you have any questions concerning insurance coverage, make certain to call my company us as well as request a quote. They will have the ability to aid you pick the right policy for your requirements.

We can not prevent the unexpected from happening, but often we can protect ourselves and also our households from the worst of the monetary after effects. Picking the right kind as well as amount of insurance is based on your specific situation, such as children, age, lifestyle, and work advantages. Four types of insurance that a lot of economists recommend consist of life, health, auto, as well as lasting special needs.

Not known Facts About Car Insurance

It includes a survivor benefit as well as additionally a money value part. As the worth grows, you can access the cash by taking a financing or taking out funds as well as you can finish the plan by taking the cash money value of the policy. Term life covers you for a collection amount of time like 10, 20, or 30 years and your premiums continue to be stable.

Lasting impairment insurance sustains those that end up being not able to work. According to the Social Safety and security Administration, one in 4 workers entering the labor force will certainly end up being disabled before they get to the age of retired life. While medical insurance spends for hospitalization and medical expenses, you are usually burdened with every one of the costs that your paycheck had actually covered (cincinnati insurance company).

This would be the most effective alternative for securing inexpensive handicap coverage. If your employer doesn't use long-term coverage, right here are some points to take into consideration before acquiring insurance coverage by yourself: A policy that assures income replacement is ideal. Many policies pay 40% to 70% of your earnings. The expense of handicap insurance is based on several aspects, including age, way of living, and also health.

About Insurance

Mostly all states need motorists to have vehicle insurance and the few that don't still hold vehicle drivers economically in charge of any type of damage or injuries they cause. Here are your choices when purchasing auto insurance policy: Liability protection: Pays for building damages as well as injuries you cause to others if you're at fault for a mishap and additionally covers litigation costs and judgments or settlements if you're taken legal action against since of a car accident. auto insurance.

Employer coverage is typically the most effective option, yet if that is not available, obtain quotes from a number of service providers as numerous offer price cuts if you buy more than one kind of protection.

The 7-Second Trick For Insurance Company

Have no fearwe'll break down whatever you need to understand about each of these kinds of insurance policy. If there's just one kind of insurance policy that you authorize up for after reading this, make it term life insurance.